What threats are insurance marketers facing this year? How can insurance companies gain ground quickly? What does marketing that’s measurable mean to an insurance executive?

C-level and executive management within the insurance sector are under the gun in 2012. The US insurance market — where 7,500 companies earn a combined annual revenue of $1 trillion — is dependent on effective marketing and accurate forecasting. With 50 of the largest companies owning more than 60% of the market, the pressure to be smarter, faster and more proactive than the competition becomes even greater.

Responsory has worked with dozens of insurance companies over the last few years (many of them are leaders within their niche and region) and compared to our manufacturing, consumer products and software industry clientele, 2012 will prove to be an unusually difficult year for insurance sector executives responsible for marketing and sales. With new and pending insurance regulations and modifications, one thing for certain will happen this year: CHANGE. Change is not to be feared, but rather to be prepared for.

That said, delivering a return on marketing investment (ROMI) is not only critical, but some CEO, CMO and other execs may even have measurable performance goals stipulated in their employment contracts. Insurance marketer’s increased workload, combined with tighter budget constraints, a plethora of marketing channel options and generally shrinking marketing departments, makes “accountability” a seemingly impossible feat. Especially since marketing credibility has become an issue among upper-level management.

So, can today’s insurance industry CMO take the heat this year? The answer is “yes!” — if they partner with Responsory. Click here to find out why.

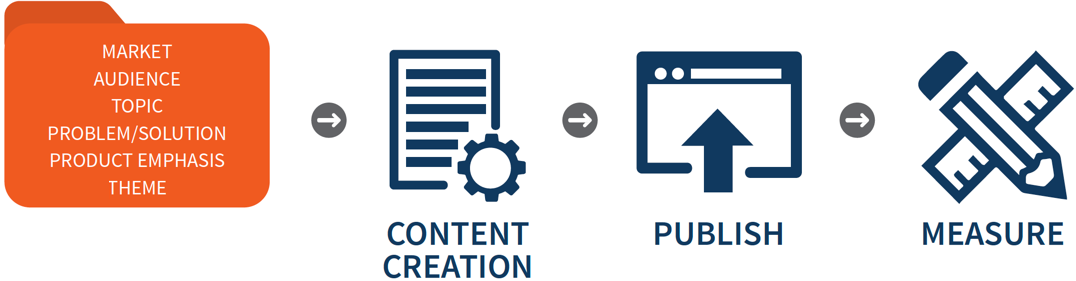

Responsory’s clients put their trust in us because they believe we’ll partner with them to strategize, plan and execute marketing programs that deliver Marketing that’s Measurable. We’d like to earn your business and add your company’s name to our prestigious client roster. I invite you to get in touch with the insurance marketing experts standing by here at Responsory to make you more successful.

If you’re an insurance marketing exec feeling the pressure, we want to hear from you!